Indeed, the first major task for every business owner deciding to sell on Amazon FBA will be the shipping of products to fulfillment centers. As an Amazon seller, you need to ensure a smooth customs clearance for your shipment to be processed and accepted into the country. In today’s article, we will provide expert tips for navigating customs clearance when shipping products from China to USA Amazon warehouses.

Understanding Customs Clearance

Customs authorities are needed to promote lawful international trade and protect the economic health of nations by overseeing the import and export of goods in various country borders.

It’s important to note that accurate documentation of your shipment is required for the successful clearance of your goods at borders by customs authorities. To avoid delays and other complications, your shipment should comply with the relevant customs regulations and laws of your destination country by identifying and preparing the documents needed for your goods to be cleared ahead of time.

Sometimes your shipment can get selected for a custom examination or inspection based on CBP algorithms or doubts regarding its customs declaration. Regardless of the situation, you are expected to follow the procedures as directed by the customs officials.

During the examination, samples of your goods or the entire shipment may be inspected by a clearance officer, to check their quantity, properties, or value. Customs examination is an official process that involves scrutinizing shipments for compliance and security and is usually carried out for goods imported into the U.S.

Also, to prevent unnecessary delays, complications and extra inventory carrying costs, an accurate and timely customs clearance can be done by an authorized customs broker to ensure that your goods move swiftly through customs checkpoints.

Preparing Documentation

Some of the necessary shipping documents required for the U.S.A customs clearance include:

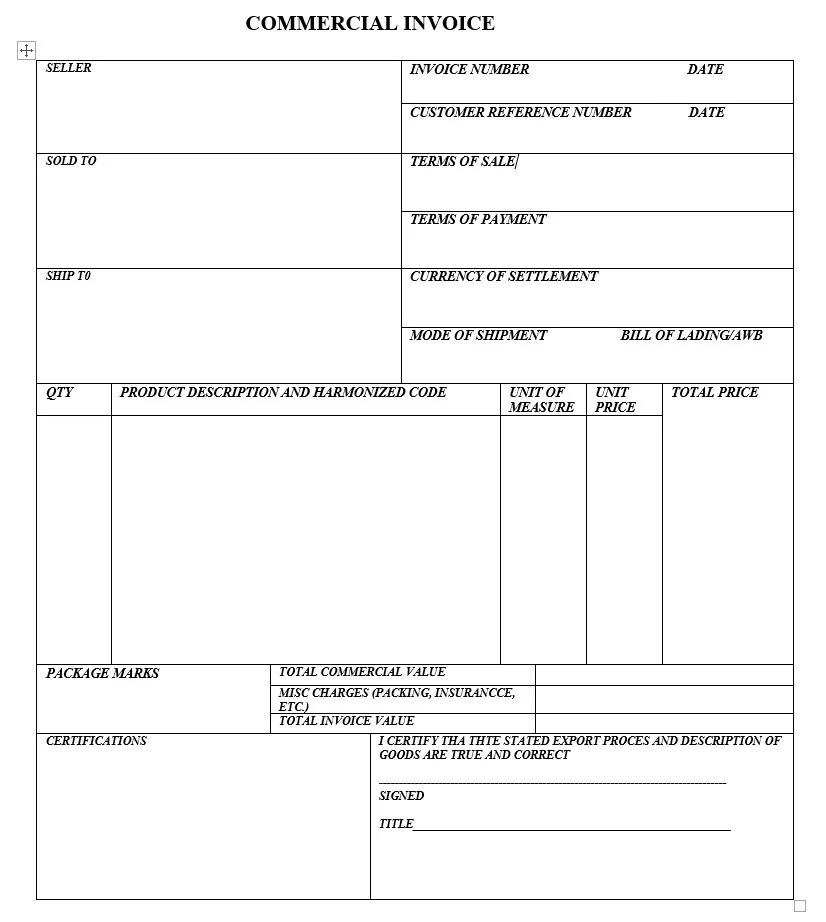

Commercial invoice

This is the first and most important document used in ocean freight shipping. It is a legal document that contains the financial interactions between the shipper and the receiver and acts as evidence of sale between them.

Without a commercial invoice, your goods cannot be cleared at customs and any form of fabrication or incomplete information on this document could lead to the rejection of cargo or legal complications.

To ensure the authenticity of your commercial invoice, it must contain the following:

(1)Transaction details such as invoice number, date issued, order number, total sale amount in USD, payment instructions in English, country of import/destination

(2)Exporter and importer information such as contact information of shipper and receiver, (name, address, phone number) in English, Tax identification number, notifying party’s information in English, reason for export

(3)Shipping Consignment information such as the description of goods number of packages, units, weight, dimension, and type of cargo) in English

(4)Other details such as HS code, incoterms, country of origin of goods, insurance details, bill of lading number, forwarding agent, date of exportation, means of transport and final destination in the US, and shipper signature with date must also be present.

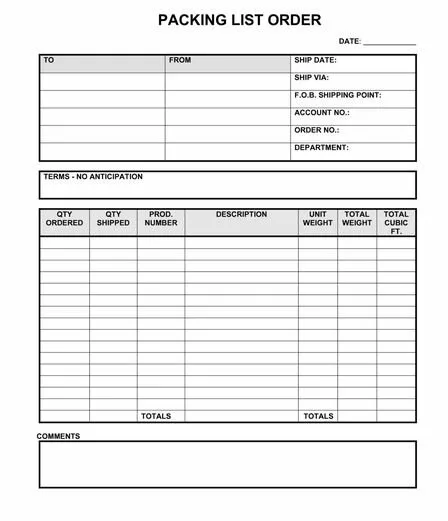

Packing list

The packing list also known as a delivery list or packing slip is a mandatory document needed for customs clearance. It is issued by the seller or shipper and contains a detailed overview of the packed items to be shipped. It contains important details about the specifications of your cargo. Some of these are:

(1) Order number

(2) Details of consignor & consignee

(3) Quantity of goods

(4) Weight of goods

(5) Description of goods

(6) Dimensions of goods (length, width, height)

(7) Handling instructions

Customs officials use this list to confirm if the shipment aligns with the data stated in the commercial invoice, bill of lading, and other documents. A packing list can also be used as a safety data sheet when shipping hazardous goods.

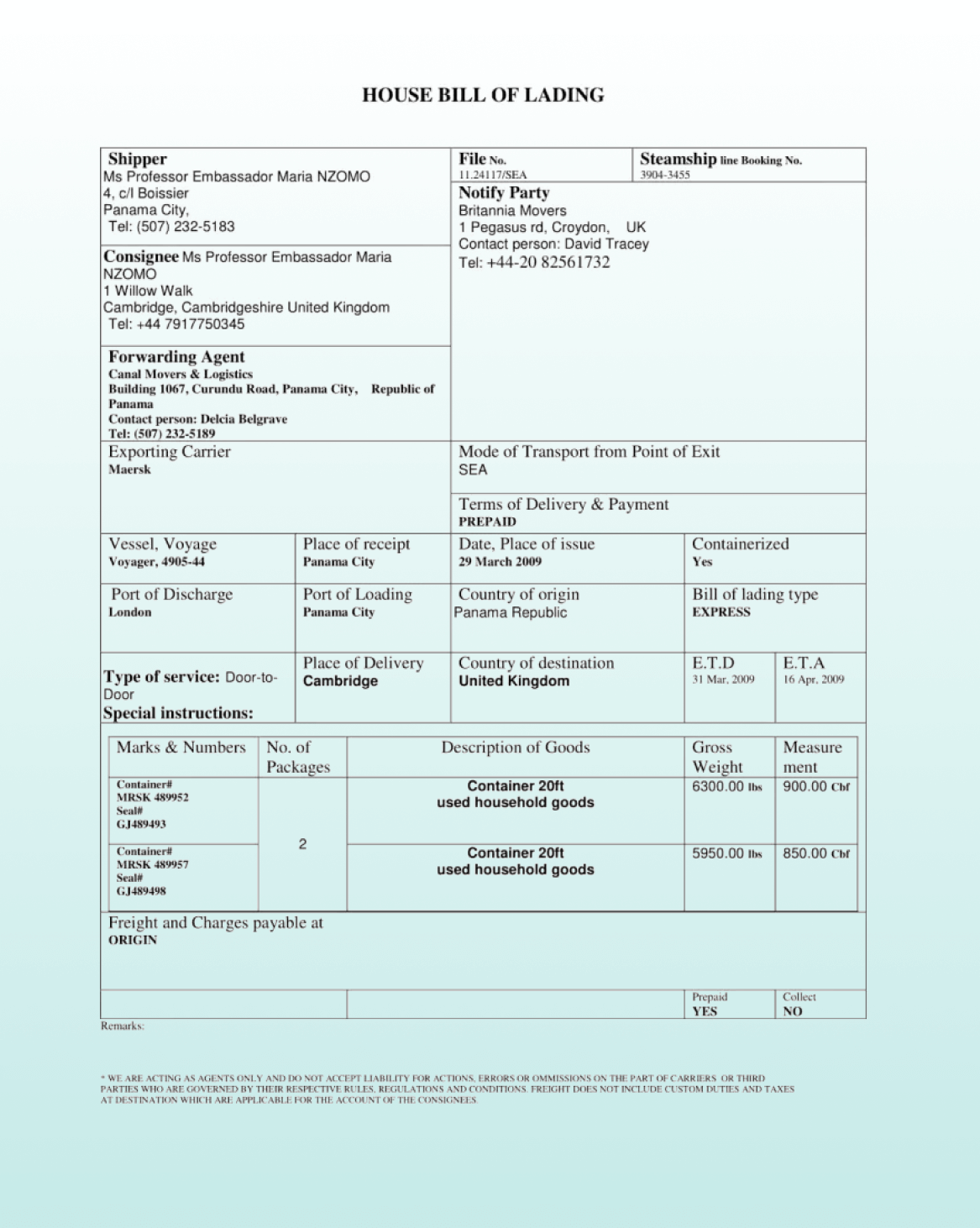

Bill of lading/airway bill

A bill of lading (BoL or B/L) is another important legal document for shipping goods to and from the US. It is similar to a commercial invoice and contains all essential details of the shipper, receiver, goods, and shipping terms.

The Bill of lading can be a negotiable or non-negotiable document. As a negotiable document, it is used to transfer ownership from one party to another after an authorized signature is added. It is signed by the carrier, shipper/seller and receiver.

The BoL carries out three essential functions by acting as:

(1) Proof of contract of carriage

(2) The title of ownership to the goods

(3) A receipt of the shipped goods

Depending on the issuing authority and purpose, there are several types of BoLs, such as house bill of lading, master bill of lading, container bill of lading, straight bill of lading, and charter bill of lading.

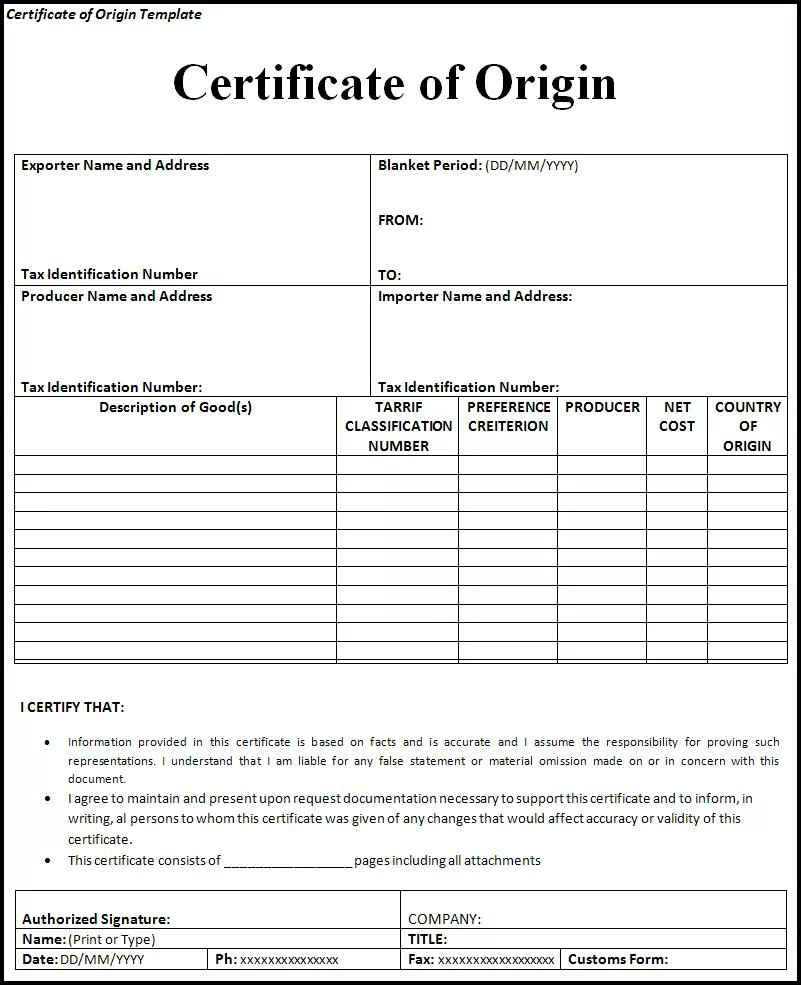

Certificate of origin

This is also known as the declaration of origin (DO), it is used to certify that the shipped goods are obtained, produced, manufactured, or processed in a particular country. As a business owner, the certificate of origin helps to verify the authenticity of your goods. It is issued for international shipments sold as a permanent export for foreign trade by the chamber of commerce of the country it originates from.

The Certificate of Origin has a validity period of 12 months from the date of issue. It regulates the duty rates, preferential trade agreements, trade sanctions, and import quotas for the shipped goods. The shipper or exporter is responsible for the certificate of origin. The authenticity of the certificate can be determined by entering a unique CO number and the chamber’s accreditation code.

Other tips for preparing accurate and complete documentation in customs clearance include double-checking all information, ensuring consistency across documents and providing additional documentation when necessary.

Product Classification

The classification of products or commodities in international trade is an essential part of customs management. You must ensure that the products in your shipment are categorized correctly based on their characteristics, purposes, and intended use to avoid violating import laws and tariff assessments to avoid delays, fines and confiscated shipments.

In 1980, the World Customs Organization approved a set of standardized codes known as Harmonized Systems for the classification of products and commodities in international trade. This code is updated every five years based on new technologies, patterns and trends in the global market and is used by over 200 countries to gather international trade statistics, research tariffs, calculate tax rates and complete other parts of the customs clearance procedures.

The Harmonized System (HS) codes allow customs authorities to easily identify a product. It consists of a six-digit number which represents over, thousands of commodity groups of different products. The first two digits of the code show the HS Chapter of the category of a specific product, the third and the fourth digits indicate the headings within that Chapter, and the last two digits show the subheading.

Some member countries like the USA use ten digits to classify products for export. Eg: the US’s Harmonized Tariff Schedule (HTS) and TARIC, the integrated Tariff of the European Union. The ten-digit code consists of the first six HS codes and then the remaining four digits code consists of a Schedule B number for every physical product assigned by the U.S. Census Bureau’s Foreign Trade Division

Some of the ways to ensure accurate product classification are by

Researching HS codes: through the use of WCO’s trade tools you can identify product categories and pay accurate tariffs.

Seeking guidance from customs brokers: based on their experience and expertise customs brokers provide services on how you can use the right HTS codes to ensure that you’re paying the correct amount of duty for your products.

Providing detailed product descriptions: so that customs officials can understand the characteristics of products being shipped.

Compliance with Regulations

As a seller or trader, certain legal requirements for imported goods must be adhered to to prevent payment of costly fines, legal issues and confiscation of goods. Some of these regulations Include:

(1) Product safety standards ensure that shipped consumer goods are safe for use or consumption. It is usually handled by the Consumer Product Safety Commission(CPSC).

(2) Labeling requirements involve guidelines responsible for creating labels and documents that include well-detailed product descriptions and the country of origin of the product.

(3) Environmental regulations consist of laws that promote the earth’s conservation and sustainability.

Other ways to stay compliant include: researching and understanding regulations that help stay up to date with changes in customs regulations of destination countries, working with certified suppliers that are reliable and experienced to navigate the process of customs clearance and obtaining necessary certifications, licenses and testing ahead of time to avoid delays.

Working with Customs Brokers

A customs broker is a private individual or firm licensed by the U.S. Customs and Border Protection (CBP) to organize customs entries, pay duties, and monitor other customs clearance processes related to importing or exporting goods. Custom brokers act as intermediaries between the shipper and the Customs authorities. An example of a customs broker is Clearit USA which helps FBA sellers ship their goods to Amazon fulfillment centers.

It is not compulsory to use a customs broker for shipping. However, experienced customs brokers have expertise in handling customs regulations and requirements. They can also streamline clearance processes as they are licensed enough to offer assisting services on product HTS codes, payments of tax and duties, and also handle documentation and paperwork needed to import or export goods.

Here are some tips that can help in selecting a reliable customs broker.

(1) Check credentials and certifications to be sure that they are legit and knowledgeable about customs requirements and practices needed to avoid errors and additional costs.

(2) Seek recommendations and reviews. You should request references to confirm the track record and reputation of the broker in your industry.

(3) Assess communication and responsiveness. Only hire a broker who is proactive and can communicate effectively and transparently about the status of your shipments.

Communication and Transparency

As a business owner, it is important to prioritize clear communication with customs authorities as it helps to maintain a positive work relationship over time. Here are some tips for effective communication:

(1) Provide accurate information by keeping up to date on customs policies and regulatory practices in your location or destination countries to avoid unnecessary delays or disputes. Also, a proper knowledge of customs regulations and documentation for your shipment helps to avoid misunderstandings and allows you to confidently engage in relevant conversations with customs officials.

(2) Responding promptly to inquiries: as a shipper or seller, you need to always be prepared because Inspections and examinations are a part of the customs clearance process.

If you receive any requests or queries from the customs officials about your freight, you should respond promptly and cooperate to provide the additional information needed because this helps you build a positive relationship with trust and rapport with the customs officials in the long run.

Finally, notify customs of any changes or updates in your shipment to avoid misunderstandings or misinterpretation of your goods.

Proactive Risk Management

It is important to Identify potential risks and challenges in shipping to prepare ahead of time. Some of these risks include:

Tariff changes. A tariff is a type of tax levied by a country on an imported good at the border.Although they serve as a means of revenue for the governments they are also used to protect domestic producers.

For shippers, tariff changes mean higher transportation expenses and potential adjustments in pricing strategies to remain competitive in the market. It can also pose a challenge for shippers to plan and budget effectively.

(1) Import restrictions by tariffs, quotas or export subsidies due to trade barriers between countries.

(2) Documentation errors can lead to shipping errors, delays, additional costs and other legal complications.

Strategies for mitigating risks include regularly monitoring regulatory changes, maintaining contingency plans and conducting internal audits and reviews.

Continuous Improvement

Every time you intend to ship goods, there is the need to constantly improve your shipping methods to avoid costly delays and penalties from customs clearance processes. Some of the strategies that can be used for improvement include

(1) Analyzing past clearance experiences by gathering adequate information on prior clearance operations, focusing on the problems and identifying how to be more efficient and compliant with customs regulations.

(2) Seeking feedback from customs brokers through one-on-one conversations, surveys, questionnaires or collaborative workshops that can address your concerns.

(3) Investing in training and education such as Customs Regulations Training applicable, Process Improvement Techniques, Cross-Functional staff Training and online classes or Certifications and other Industry Conferences and Seminars to do a follow up of latest global market trends in your industry.

Conclusion

For you to successfully ship goods from China to the USA or anywhere in the world, you need to plan by preparing your custom documentation, shipping costs and other customs requirements in advance. It’s important to also hire a reliable customs broker who will comply with customs regulations and communicate effectively with the customs officials.

We hope that these few tips have been helpful as you navigate the journey to a smoother shipping experience.